Course offerings

FEATURED COURSES

Course overview

We have a broad range of topics covering the most important skills and elements for becoming a (better) trader.

Click on the courses below for more info in PDF

Derivatives

HFT - High-frequency trading

Annual University Summer Trading

- Hong Kong

- Taiwan

- Shanghai

Partners

We aim to fulfill our mission by gathering the most talented and specialized professionals in the trading business as lecturers and providing hands-on education in state of the art trading laboratories throughout Asia, partnering with the most prominent universities in the region.

We work with the following business partners:

- RealTime Trading Systems (RTS)

- Deutsche Boerse / Eurex

- T8 Software

- CQG

Cooperation with our Academic Partners

- Chinese University of Hong Kong (CUHK)

- Lecturing at National Taiwan University (NTU)

- NTU-SGX Centre for Financial Education Singapore

- Taiwan Securities & Futures Institute (SFI)

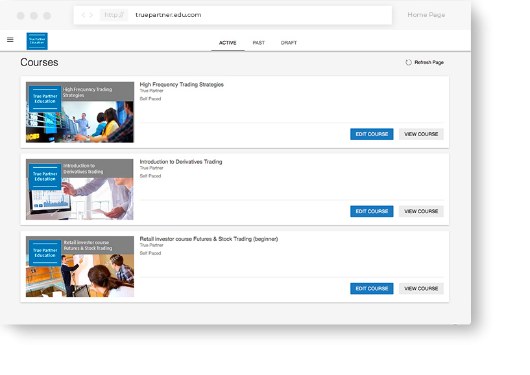

Online Learning

Use the TPEDU platform to learn

Next to the live classes, you can follow the courses online also. Our learning platform has courses which you can complete at your own pace, get the certificates comfortable behind your laptop from anywhere.

Keep overview of your proceedings to achieve the best learning experience within your available time. You can follow multiple courses simultaneously if you like. Or take a break if needed.

Trading Labs to learn faster

The students being trained inside the Lab are working in simulated situations – they are using real market data but none of their trades actually reach the exchanges. Of course the trades don’t go to the exchanges but it looks like it does. It doesn’t go to the exchanges but you are trading real prices.

The system tools students are being trained up on in the Lab, are precisely the ones they will be using in the real world, thereby saving these organizations a lot of time and money. It would normally take a company six months to get students up to speed. At the Trading Lab it can be achieved in two semesters by using Professional (Typhoon) Trader software like in the real world. So if you leave the Trading Lab sucessfully, you can be hired by a trading company immediately.

Teachers about the Labs

“The uniqueness is that students will be led by professional traders in class. They can experience how the financial market changes rapidly and be fast to analyze the situation for clients. Trading Labs help students to bridge theory and practice.”